Rebecca Lake is a certified educator in personal finance (CEPF®) and freelance writer specializing in finance.

Expertise: Insurance planning, education planning, retirement planning, investment planning, military benefits, behavioral finance

Erin Kinkade, CFP®, ChFC®, works as a financial planner at AAFMAA Wealth Management & Trust. Erin prepares comprehensive financial plans for military veterans and their families.

A home equity line of credit (HELOC) is a revolving credit line secured by your home equity. Your equity is the difference between what your home is worth and what’s remaining on the mortgage.

HELOCs can be an attractive way to tap into cash for debt consolidation, home improvements, or other expenses. You may access your equity within a few weeks and use the money for any purpose.

You’ll need several key pieces of information to apply for a HELOC. Knowing what documents are needed can help you prepare.

Table of Contents Skip to Section

No documents needed to prequalify without impacting your credit

The documents needed for HELOC applications are similar to what most lenders require when applying for a mortgage. Lenders ask for documents to verify your identity, income, assets, and property details.

The lender will first want to verify that you’re the person whose name is on the HELOC application. Expect to provide:

The lender will use your name and Social Security number to obtain your credit reports, which it will need to approve your HELOC application. Your lender will ask for permission before it checks your credit.

The next set of documents you’ll need for a HELOC application covers your income and assets. The lender uses this and your credit reports to determine your ability to repay what you borrow.

The documentation you’ll need to verify income can depend on whether you’re employed in a traditional job, self-employed, retired, disabled, or receiving domestic support payments.

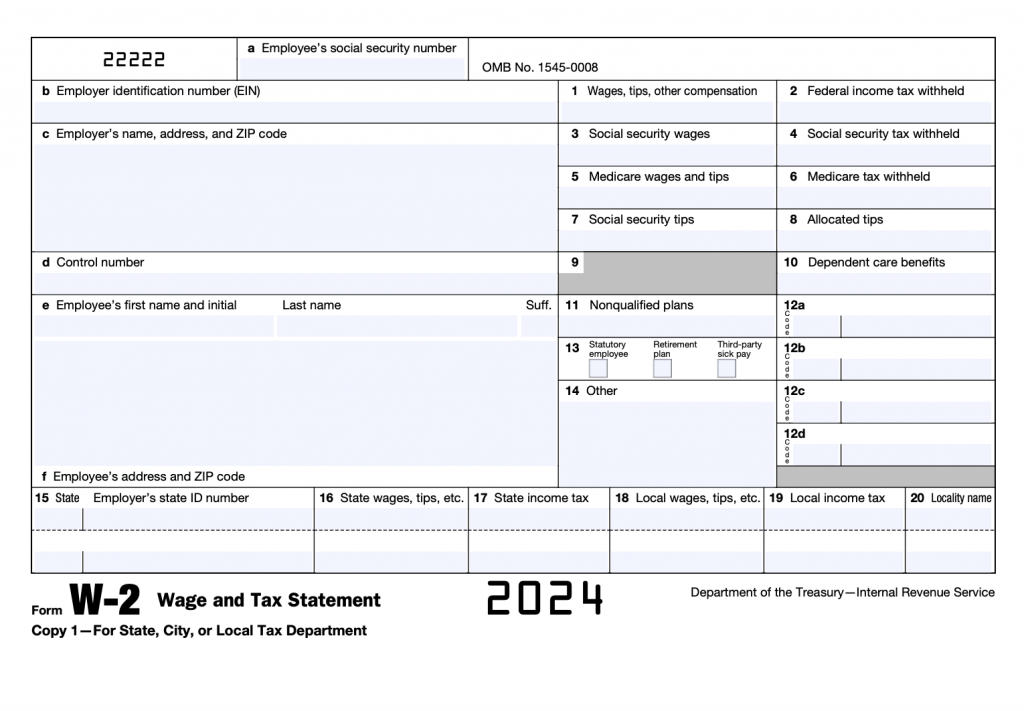

The income documents you may need to apply for a HELOC include:

Lenders also consider certain assets to demonstrate your ability to pay. Asset documentation can include:

This may exclude assets you hold on another’s behalf. For example, if you have custodial bank accounts or 529 college savings accounts set up for your children, the lender may not need to see documentation of these.

The final piece of the puzzle is the home itself. The lender will want to know how much you owe on the mortgage, what the home is worth, and how much insurance you have.

Required documentation often includes:

Most of the time, you’ll also need an appraisal to apply for a HELOC. Once you submit your application, the lender will schedule the appraisal to determine the home’s value.

The documentation you’ll need for a HELOC depends on your situation. If you think special circumstances apply to you, it’s helpful to know whether a lender might request any extra documentation to process your application.

Here are several examples of when additional documents might be necessary.

Self-employment means you don’t draw a regular paycheck from an employer. As such, lenders may scrutinize your income to ensure you can repay a HELOC.

Instead of pay stubs or W-2s, your lender might ask for:

Your lender may also request a letter of verification proving you’re self-employed. For instance, if you’re a freelancer, you may need to provide a letter from one or more clients attesting to your status as an independent contractor.

Retirement often means you replace your paychecks with pension income, retirement account distributions, Social Security benefits, or some combination of these. If you’re disabled, you might rely on Social Security disability benefits as your primary source of income.

In either case, you might need the following documents to apply for a HELOC:

Your lender may permit you to substitute bank statements for other income documentation if you show recurring retirement or disability income deposits.

Living in a flood zone can heighten risk when applying for a HELOC. Lenders may expect to see a declaration of flood insurance to approve you.

If you’re required to provide proof of flood insurance, you’ll provide your:

Your insurance company should be able to provide you with a declaration or send it to the lender on your behalf.

The process for submitting documents needed for a HELOC can depend on what’s required and the lender.

You can apply for a HELOC one of three ways:

If you’re applying online, the lender may allow you to upload and submit documents electronically. This can save time, and you may be able to get preapproved to check your rates.

However, you might be more comfortable applying for a HELOC over the phone or in person. In that case, the lender may ask you to provide original or duplicate hard copies or share a link to an online portal where you can submit documents.

You don’t have to provide certain documents when applying for a HELOC. Instead, the lender collects these documents for you. Note that a fee might apply for that convenience.

The lender is responsible for documents including:

Your closing paperwork should include a breakdown of the fees you’ll pay the lender and what they cover. Typical closing costs for a HELOC are 2% to 5% of the loan amount.

If you’re completing a joint HELOC application with a spouse or co-homeowner, you’ll both need to provide the required documentation.

These can include:

Lenders can look at both your credit histories and debt profiles, as well as your income and assets, when determining whether to approve you for a HELOC. Applying for a joint HELOC could allow you to qualify for a larger credit line if you both have good credit histories.

To maintain our free service for consumers, LendEDU sometimes receives compensation when readers click to, apply for, or purchase products featured on the site. Compensation may impact where & how companies appear on the site. Additionally, our editors do not always review every single company in every industry.